Earned Value Analysis: Measurement and Control Techniques

- Michelle M

- Dec 23, 2025

- 8 min read

Introduction

In business, delivery performance cannot be credibly assessed through narrative status updates, subjective commentary, or isolated metrics viewed in isolation. Large organizations manage complex portfolios of initiatives that span business transformation, technology delivery, infrastructure investment, and regulatory change.

These initiatives often involve significant capital expenditure, executive oversight, and interdependent delivery teams operating across functions and geographies. In this context, leadership requires objective, comparable, and forward-looking indicators that provide a clear view of whether investments are performing as intended. Earned value analysis exists to meet precisely that need.

Earned value analysis is not a reporting formality or an academic project management technique. It is a disciplined control mechanism that integrates scope, schedule, and cost into a single, coherent analytical framework.

When applied correctly, it enables early detection of performance deviation, quantifies delivery risk before it becomes visible through missed milestones or budget overruns, and supports evidence-based decision-making at portfolio and executive levels.

When applied poorly or superficially, however, it quickly degrades into a compliance exercise that consumes effort without delivering insight.

This article explains earned value analysis from an enterprise and corporate perspective. It clarifies why it matters for governance, investment assurance, and executive confidence, how it is applied at scale across complex delivery environments, and how PMOs and senior leaders use it to protect value, improve predictability, and strengthen delivery credibility across the organization.

What Does Earned Value Analysis Mean?

Earned value analysis is a performance measurement technique that compares the value of work performed against the planned value and actual cost incurred.

At enterprise scale, it answers three fundamental questions:

Are we delivering what we planned

Are we delivering it when we planned

Are we delivering it within approved cost

By integrating these dimensions, earned value analysis provides insight that isolated schedule or cost reports cannot.

Core Components of Earned Value Analysis

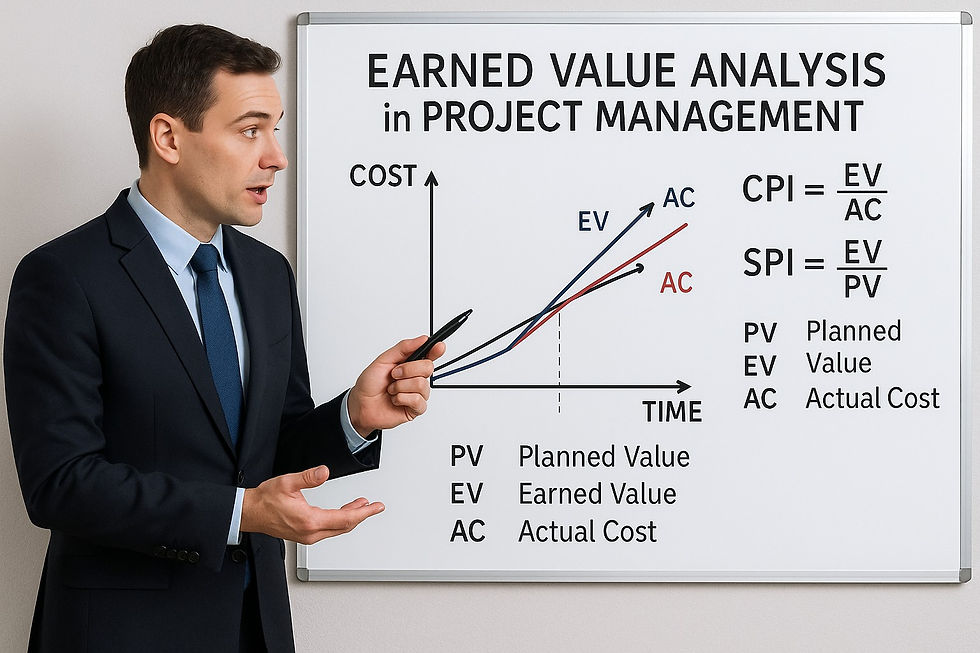

Earned value analysis is built on three core data elements.

These include:

Planned value, representing the authorized budget for scheduled work

Earned value, representing the budgeted value of work actually completed

Actual cost, representing the cost incurred for the completed work

These elements form the basis for all earned value calculations and indicators.

Why Enterprises Use Earned Value Analysis

Large organizations use earned value analysis because complexity obscures performance.

The technique is used to:

Detect performance issues early

Quantify schedule and cost variance objectively

Support credible forecasting

Enable consistent reporting across initiatives

Provide defensible evidence for governance decisions

In regulated or capital-intensive environments, these benefits are essential.

Earned Value and Enterprise Governance

Enterprise governance relies on objective evidence rather than optimism.

Earned value analysis supports governance by:

Providing standardized performance indicators

Enabling comparison across projects and programs

Supporting escalation based on thresholds

Reducing reliance on subjective status reporting

This improves confidence in portfolio oversight.

Schedule Performance and Earned Value

Traditional schedule tracking focuses on dates and milestones. Earned value focuses on progress.

Schedule performance indicators derived from earned value analysis reveal whether work is progressing as planned, regardless of reported milestones.

This helps enterprises identify hidden delays before they become critical.

Cost Performance and Financial Control

Cost overruns often emerge gradually. Earned value analysis makes them visible early.

By comparing earned value to actual cost, organizations can identify inefficiency and cost pressure while corrective action is still viable.

This supports stronger financial control and investment protection.

Forecasting Using Earned Value

One of the most valuable aspects of earned value analysis is forecasting.

Enterprises use earned value data to:

Predict final cost and completion dates

Assess the impact of current performance trends

Evaluate recovery scenarios

Forecasting supports proactive decision-making rather than reactive response.

Earned Value at Portfolio and Program Levels

While often associated with projects, earned value analysis is increasingly used at higher levels.

At program level, it supports coordination across interdependent initiatives.

At portfolio level, aggregated earned value indicators provide insight into overall investment health.

This enables executives to manage performance holistically.

Use in Capital-Intensive and Regulated Industries

Industries such as construction, energy, defense, and infrastructure rely heavily on earned value analysis.

In these environments, it supports:

Contractual performance monitoring

Regulatory reporting

Claim and dispute resolution

Investment assurance

The discipline of earned value is aligned with external scrutiny.

Integration With PMO and Control Functions

PMOs play a critical role in enabling earned value analysis.

They ensure:

Consistent application of standards

Quality of baseline data

Integrity of reporting

Appropriate interpretation of indicators

Without PMO discipline, earned value analysis loses credibility.

Common Enterprise Misuse of Earned Value

Earned value analysis is often misapplied.

Common failure modes include:

Treating earned value as a reporting formality

Using inaccurate or unstable baselines

Overemphasizing metrics without context

Applying earned value to unsuitable work types

These issues undermine trust and usefulness.

Suitability of Earned Value Analysis

Earned value analysis is most effective where:

Scope can be reasonably defined

Work progress can be objectively measured

Cost data is reliable

Enterprises must apply it selectively and appropriately.

Example: Earned Value in a Large Transformation Program

A global enterprise runs a multi-year transformation program.

Earned value analysis reveals early schedule slippage masked by milestone reporting. Leadership intervenes, reallocates resources, and adjusts sequencing.

As a result, the program recovers trajectory before significant value erosion occurs.

Linking Earned Value to Decision-Making

Metrics alone do not deliver value. Decisions do.

Enterprises use earned value outputs to:

Trigger governance escalation

Approve corrective action

Rebaseline when justified

Adjust funding and priorities

This linkage turns analysis into action.

Data Quality and Baseline Discipline

Earned value analysis depends on baseline integrity.

Enterprises enforce:

Formal baseline approval

Change control discipline

Clear progress measurement criteria

Strong data quality underpins credible analysis.

Earned Value and Agile or Hybrid Delivery

While traditionally associated with predictive delivery, enterprises adapt earned value concepts to agile and hybrid models.

They focus on:

Value delivered rather than tasks completed

Incremental progress measurement

Alignment with financial controls

This adaptation preserves governance while supporting modern delivery.

Reporting Earned Value to Executives

Executives require clarity, not technical detail.

Effective reporting:

Focuses on trends and implications

Links metrics to risk and decision options

Avoids metric overload

Interpretation is as important as calculation.

Skills Required to Use Earned Value Effectively

Earned value analysis requires skilled application.

Key capabilities include:

Understanding of delivery models

Financial literacy

Analytical interpretation

Communication with senior stakeholders

Training and experience are critical.

Technology Support for Earned Value Analysis

Enterprises use tools to support earned value.

These include:

Project and portfolio management platforms

Financial systems

Integrated reporting dashboards

Tools support scale, but governance ensures accuracy.

Measuring the Value of Earned Value Analysis

Enterprises assess value through:

Improved forecast accuracy

Earlier detection of issues

Reduced cost overruns

More effective intervention

These outcomes justify the discipline.

Future Evolution of Earned Value in Enterprises

Earned value analysis continues to evolve.

Trends include:

Integration with real-time data

Enhanced visualization

Alignment with value-based management

The core principles remain relevant.

Practical Guidance for Executives

To maximize benefit from earned value analysis:

Use it as a decision tool, not a report

Ensure baseline and data discipline

Apply it where appropriate

Invest in capability and interpretation

Link metrics to governance action

This ensures earned value supports value protection.

Frequently Asked Questions (FAQ)

What is earned value analysis in an enterprise context?

Earned value analysis (EVA) is a structured performance management technique that integrates scope, schedule, and cost to provide a single, objective view of delivery performance. In enterprise environments, it is used as a governance and control mechanism rather than a project-level reporting tool. EVA enables executives, PMOs, and portfolio leaders to assess whether investment is translating into actual progress and value realization.

Why is earned value analysis important for large organizations?

Large organizations manage complex portfolios with interdependencies, regulatory oversight, and significant financial exposure. Earned value analysis provides early warning signals when performance deviates from plan, allowing leaders to intervene before delays or overruns escalate. It supports consistency, comparability, and transparency across initiatives, which is essential for governance, auditability, and executive decision-making.

How does earned value analysis differ from traditional project reporting?

Traditional reporting often relies on narrative updates, milestone tracking, or isolated cost reports. These approaches can obscure underlying issues and lag behind reality. Earned value analysis, by contrast, objectively measures progress against the approved baseline, linking what has been delivered to what has been spent and when it was planned. This integration makes EVA more predictive and actionable.

Is earned value analysis only relevant for large or capital-intensive projects?

While earned value analysis is most commonly associated with large, complex, or regulated initiatives, its principles are applicable across portfolios of varying size. In enterprise settings, EVA is often scaled and tailored based on risk, value, and complexity. The key is proportional application, not universal over-engineering.

What are the key data inputs required for effective earned value analysis?

Effective earned value analysis depends on three core elements: a clearly defined and baselined scope, a realistic and integrated schedule, and accurate cost tracking. Without disciplined planning and reliable data, EVA metrics lose credibility and value. Strong configuration management and change control are therefore essential prerequisites.

How do executives and PMOs use earned value metrics?

Executives and PMOs use earned value metrics to identify trends, compare performance across initiatives, and prioritize management attention. Metrics such as cost performance index (CPI) and schedule performance index (SPI) support fact-based discussions about risk, recovery options, and investment decisions. At portfolio level, EVA supports capital allocation and delivery assurance.

What are common mistakes organizations make with earned value analysis?

Common pitfalls include treating earned value as a compliance exercise, applying it without sufficient planning maturity, or focusing on metrics without linking them to decisions and corrective actions. Another frequent issue is inconsistent application across projects, which undermines comparability and trust in the data.

How can organizations ensure earned value analysis delivers real value?

To deliver real value, earned value analysis must be embedded within enterprise governance, supported by leadership, and used to drive decisions rather than reports. Clear standards, training, and integration with portfolio management processes ensure that EVA becomes a practical control capability rather than an administrative burden.

Is earned value analysis compatible with agile or hybrid delivery models?

Yes, when adapted appropriately. Many enterprises apply earned value principles within hybrid or agile frameworks by aligning value delivery, increments, or work packages to measurable baselines. The focus remains the same: objective visibility of progress, cost, and schedule performance at scale.

Discover a detailed guide on "Earned value management" from Wikipedia

Conclusion

Earned value analysis remains one of the most effective control mechanisms available to large organizations that need visibility, predictability, and accountability across complex delivery portfolios. In enterprise environments, where initiatives compete for capital, executive attention, and scarce resources, leaders cannot rely on narrative reporting or lagging indicators to understand performance.

Earned value analysis provides an integrated, evidence-based view of scope, schedule, and cost that enables informed decision-making before problems escalate.

When implemented with discipline and supported by consistent data standards, earned value analysis strengthens governance rather than adding administrative burden. It allows executives and PMOs to identify emerging risk early, distinguish between temporary variance and structural failure, and intervene with confidence. Just as importantly, it creates a common performance language across projects, programs, and portfolios, improving comparability and reinforcing accountability at scale.

However, the value of earned value analysis is not automatic. It depends on leadership intent, maturity of planning practices, and a clear understanding of how the metrics are used to drive action rather than compliance.

Organizations that treat earned value as a control tool, embedded within portfolio management and investment assurance, gain far greater benefit than those that apply it as a reporting requirement.

For enterprises seeking predictable delivery, stronger investment assurance, and improved credibility with boards, regulators, and stakeholders, earned value analysis is not optional. It is a foundational capability that connects planning discipline to execution performance and transforms delivery data into strategic insight.