What Is Earned Value Analysis in Project Management: An Ultimate Guide

- Michelle M

- Oct 27, 2025

- 6 min read

Project managers need to balance cost, time, quality and scope while demonstrating measurable progress. This balance is rarely achieved through intuition alone it requires structure, metrics, and transparency.

That is where Earned Value Analysis (EVA) becomes essential. It is a performance measurement technique that integrates cost, schedule, and scope to provide a clear picture of a project’s true progress. Used effectively, it helps corporations predict future outcomes, make data-driven decisions, and maintain governance across portfolios.

What Is Earned Value Analysis in Project Management? It is not just an accounting exercise; it is a strategic governance tool that supports project maturity, executive reporting, and financial accountability.

Understanding Earned Value Analysis (EVA)

At its core, Earned Value Analysis compares what has been accomplished with what was planned and what has been spent. It answers three critical corporate questions:

Are we on schedule?

Are we within budget?

Are we getting value for our investment?

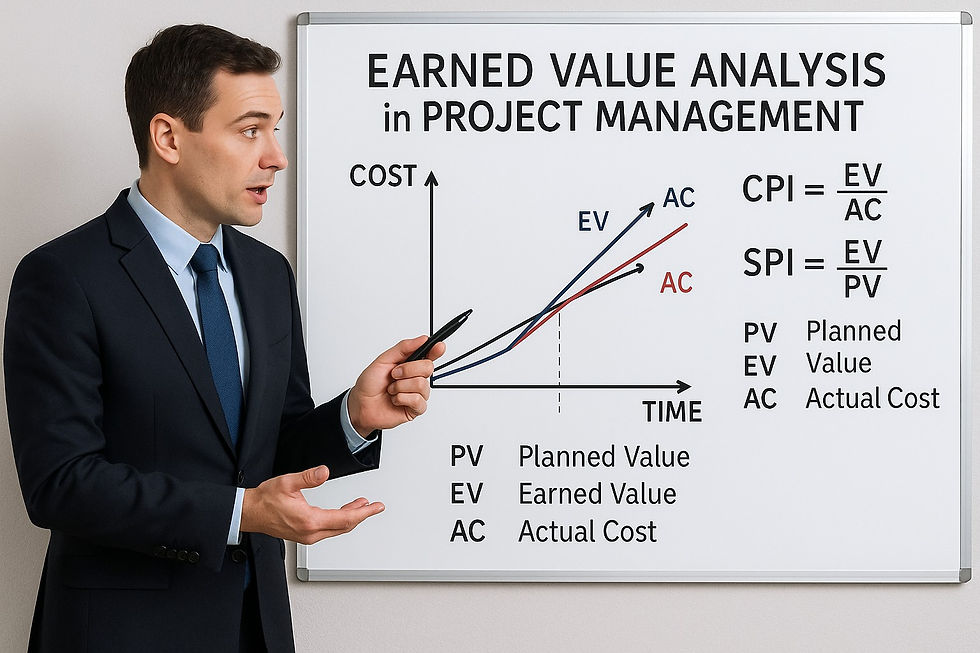

EVA integrates three dimensions:

Planned Value (PV): The authorized budget for scheduled work.

Earned Value (EV): The budgeted value of work actually completed.

Actual Cost (AC): The cost incurred for completed work.

By analyzing the relationships between these metrics, executives gain early visibility into project performance, allowing for timely corrective actions.

The Corporate Importance of Earned Value Analysis

In a large organization, projects are interconnected. A single delay or cost overrun can cascade across portfolios, affecting resource allocation and profitability. Earned Value Analysis provides a consistent framework for measuring and managing these impacts.

Corporate Benefits of EVA

Performance Visibility: Offers real-time insight into schedule and cost variance.

Predictive Control: Enables forecasting of final cost and completion dates.

Governance Alignment: Standardizes reporting across all business units.

Risk Management: Identifies deviations early for proactive intervention.

Financial Accountability: Connects project execution to corporate financial systems.

EVA converts project performance into quantifiable data that can be shared confidently with stakeholders, investors, and boards.

How Earned Value Analysis Supports Corporate Governance

Corporate governance requires more than reports it requires assurance. Earned Value Analysis provides that assurance by connecting operational activity with strategic intent.

In large enterprises, executives need to know whether project investments are producing measurable value. EVA ensures that data from project teams, finance, and PMOs align with corporate objectives.

EVA’s Role in Governance

Portfolio Standardization: Ensures all projects report performance using the same structure.

Strategic Decision Support: Provides empirical data for executive dashboards.

Audit Trail: Establishes a documented basis for compliance and financial review.

Continuous Improvement: Offers insights for refining future project estimates.

Through EVA, organizations transform data into actionable intelligence, improving trust and accountability across the project ecosystem.

The Core Components of Earned Value

Understanding the key terms is crucial before applying EVA.

1. Planned Value (PV)

Also known as the Budgeted Cost of Work Scheduled (BCWS), PV represents the baseline budget assigned to specific work packages over time. It shows what should have been completed by a given date.

2. Earned Value (EV)

Also called Budgeted Cost of Work Performed (BCWP), EV represents the approved budget for the work actually completed. It reflects true performance.

3. Actual Cost (AC)

Also known as Actual Cost of Work Performed (ACWP), AC is the total expenditure incurred to complete the work.

When combined, these three values allow corporate teams to calculate key performance indicators that reveal how efficiently a project is being delivered.

Key Metrics in Earned Value Analysis

The strength of EVA lies in its quantitative metrics, which provide objective measurements of cost and schedule performance.

Cost Variance (CV)

CV = EV - ACIndicates whether the project is under or over budget.

Positive CV: Under budget.

Negative CV: Over budget.

Schedule Variance (SV)

SV = EV - PVShows whether work is ahead or behind schedule.

Positive SV: Ahead of schedule.

Negative SV: Behind schedule.

Cost Performance Index (CPI)

CPI = EV / ACMeasures cost efficiency. A CPI greater than 1 indicates efficiency, while less than 1 indicates overspending.

Schedule Performance Index (SPI)

SPI = EV / PVMeasures schedule efficiency. Values above 1 show acceleration, below 1 indicate delays.

Estimate at Completion (EAC)

EAC = BAC / CPIForecasts total project cost at completion based on current performance.

Variance at Completion (VAC)

VAC = BAC - EACProjects whether the final cost will be over or under budget.

For corporations, these indicators serve as key governance metrics that allow

leadership to track, compare, and benchmark performance across multiple portfolios.

Applying Earned Value in a Corporate Setting

EVA is most effective when applied consistently through a structured PMO framework. Corporate environments require scalable systems that integrate cost, schedule, and performance data across departments and programs.

Corporate Implementation Steps

Establish a Baseline: Define scope, schedule, and budget at project initiation.

Integrate Systems: Connect scheduling tools (such as Primavera P6 or MS Project) with financial systems (like SAP or Oracle).

Define Work Breakdown Structures (WBS): Organize deliverables and cost codes.

Set Performance Thresholds: Determine acceptable variance limits.

Monitor and Report: Track performance regularly and escalate deviations.

This process ensures that project teams, finance officers, and executives operate from the same data foundation.

PMO Integration and Oversight

In a corporate environment, the Project Management Office (PMO) plays a central role in Earned Value governance.

PMO Responsibilities Include:

Establishing corporate EVA standards and templates.

Conducting variance analysis across portfolios.

Providing executive dashboards with cost and schedule KPIs.

Ensuring compliance with audit and quality standards.

Facilitating lessons learned and continuous improvement cycles.

The PMO ensures that EVA data is accurate, timely, and aligned with corporate reporting requirements.

Executive Reporting and Decision Support

Executives depend on concise, accurate data to make strategic decisions. Earned Value Analysis provides the foundation for executive dashboards that integrate financial, operational, and schedule data.

Benefits for Executives

Early Warning Indicators: Enables proactive decision-making before performance declines.

Cross-Portfolio Comparisons: Identifies trends across projects and departments.

Financial Forecasting: Supports corporate budgeting and capital allocation.

Board-Level Transparency: Provides defensible, data-driven status updates.

In mature organizations, EVA results feed directly into enterprise analytics systems, supporting both tactical and strategic planning.

Common Corporate Challenges in Implementing EVA

Despite its value, implementing Earned Value Analysis across large organizations can be complex.

Typical Challenges Include:

Data Integration Issues: Misalignment between scheduling and financial systems.

Resistance to Transparency: Teams hesitant to expose performance gaps.

Inconsistent Methodologies: Variations in how different divisions apply EVA.

Training Gaps: Lack of understanding among non-technical stakeholders.

Cultural Barriers: Preference for reactive management over predictive analytics.

These challenges can be mitigated through governance discipline, executive sponsorship, and continuous education.

Overcoming Barriers to Earned Value Success

To embed EVA successfully, corporations must align people, processes, and technology.

Key Strategies for Success

Leadership Commitment: Executives must sponsor and champion EVA adoption.

PMO Training Programs: Build organizational capability through workshops and certifications.

Standardized Tools: Use consistent software platforms and reporting formats.

Automated Data Integration: Eliminate manual data manipulation to reduce error.

Performance Culture: Reward transparency and continuous improvement.

By embedding EVA principles into governance frameworks, corporations can transform performance monitoring from a reporting function into a decision-making asset.

Earned Value and Risk Management

Earned Value Analysis is not limited to performance tracking it also strengthens risk management.

When variances occur, EVA highlights deviations early, allowing leaders to implement corrective actions before costs escalate. For example, a declining Cost Performance Index can trigger procurement reviews or contract renegotiations.

By integrating EVA into corporate risk frameworks, organizations gain a real-time lens on potential financial or operational exposures.

Earned Value in Multi-Project Environments

In large corporations, multiple projects often compete for shared resources and budgets. EVA supports portfolio-level optimization by providing consistent metrics across initiatives.

Benefits at the Portfolio Level

Aggregated performance dashboards for all active projects.

Comparison of CPI and SPI across business units.

Early identification of systemic performance issues.

Support for investment prioritization and capital reallocation.

This cross-project visibility enables PMOs and CFOs to make data-driven decisions about resource balancing and strategic funding.

Linking Earned Value to Business Outcomes

EVA’s ultimate purpose is not reporting it is enabling better business outcomes. When properly implemented, it aligns operational execution with strategic intent.

Corporate leaders can use EVA data to answer questions such as:

Are we realizing the expected benefits of this investment?

How effectively are resources being utilized?

What lessons can improve future portfolio planning?

By connecting project metrics to corporate objectives, organizations achieve a full view of performance from investment to outcome.

The Future of Earned Value in Corporate Project Management

As technology evolves, Earned Value Analysis is becoming more automated, integrated, and predictive.

Future Trends Include:

AI-Driven Forecasting: Predicting future CPI and SPI using historical data.

Real-Time Dashboards: Instant variance reporting for executives.

Cloud-Based PMO Platforms: Unified access for distributed teams.

Hybrid Delivery Models: EVA applied to Agile and hybrid frameworks.

Sustainability Metrics: Integrating ESG performance into earned value reporting.

The next generation of EVA will not only measure value but also optimize it across portfolios.

Conclusion - What Is Earned Value Analysis in Project Management: An Ultimate Guide

Earned Value Analysis is more than a set of calculations it is a corporate discipline that enhances visibility, accountability, and strategic control.

By integrating EVA into governance frameworks, corporations bridge the gap between planning and performance, ensuring that every investment delivers measurable results. From cost management to executive reporting, it provides the transparency required to maintain trust, control risk, and drive sustainable value across the enterprise.

Professional Project Manager Templates are available here

Key Learning Resources can be found here:

Hashtags

#EarnedValueAnalysis #CorporatePMO #ProjectGovernance #PerformanceMeasurement #EVAinProjects #ProjectControl #StrategicReporting #CostManagement #SchedulePerformance #PortfolioManagement #PMOGovernance #RiskManagement #CorporateStrategy #BusinessIntelligence #OperationalExcellence