Portfolio Prioritization Strategies That Align with Strategic Goals

- Michelle M

- 6 days ago

- 10 min read

Organizations are constantly juggling multiple projects, initiatives, and investments, each competing for limited resources, time, and executive attention. The challenge for leaders is not merely completing projects efficiently, but ensuring that every effort aligns with overarching strategic objectives and delivers measurable business value.

This is where portfolio prioritization becomes an indispensable tool. By systematically evaluating which projects matter most, organizations can optimize resource allocation, reduce operational inefficiencies, and maximize returns on their strategic investments.

Portfolio prioritization is more than a checklist or ranking system it is a strategic discipline that ensures alignment between the company’s vision, long-term goals, and day-to-day project execution.

Without an intentional prioritization framework, organizations risk pursuing initiatives that are misaligned with their strategy, overcommitting resources, or failing to respond quickly to evolving market opportunities. In an enterprise context, where projects span multiple departments, geographies, and functions, this misalignment can translate into costly delays, missed opportunities, and diminished competitive advantage.

The process of portfolio prioritization requires a holistic understanding of organizational objectives, operational capacity, and risk tolerance. Leaders must balance short-term wins with long-term investments, weigh potential benefits against associated risks, and consider the interdependencies among projects. Furthermore, successful prioritization demands transparency, collaboration, and stakeholder engagement to ensure that decisions are informed, objective, and widely supported across the enterprise.

In this blog, we will explore portfolio prioritization strategies that empower organizations to make data-driven, strategic decisions about which projects to pursue, defer, or reallocate.

We will examine the frameworks, tools, and best practices that drive successful prioritization, and provide insights into how enterprises can align their portfolios with business goals to achieve sustainable growth, operational efficiency, and strategic impact.

Whether you are a project manager, portfolio leader, or executive, understanding and implementing these strategies is critical for steering your organization toward measurable success in today’s dynamic business environment.

Understanding Portfolio Prioritization in Strategic Planning

Portfolio prioritization is a systematic approach to selecting and managing projects that align with an organization's strategic goals. It involves evaluating potential initiatives to ensure that resources are directed toward the most impactful projects.

This process is not merely about choosing which projects to pursue; it is a critical component of strategic planning that helps organizations maximize return on investment and achieve long-term objectives. By understanding the strategic significance of each project, organizations can create a focused portfolio that enhances

their competitive edge.

Effective portfolio prioritization requires a deep understanding of the organizational strategy. Leaders must develop a clear vision that articulates the company's goals and how potential projects contribute to those goals. This vision serves as a guiding framework for evaluating and prioritizing initiatives. Companies are encouraged to regularly assess their strategic goals in light of changing market conditions, allowing for agile adjustments in portfolio prioritization.

Additionally, successful portfolio prioritization fosters a culture of collaboration and transparency. By involving key stakeholders in the decision-making process, organizations can ensure that diverse perspectives are considered. This collaborative approach not only enhances buy-in from team members but also increases the likelihood of selecting projects that genuinely align with the company's vision and long-term objectives.

Key Factors Influencing Portfolio Prioritization Decisions

Several factors play a crucial role in influencing portfolio prioritization decisions within organizations. First, organizational alignment is paramount; initiatives must support the company's strategic direction and goals. When projects are in harmony with strategic objectives, they are more likely to receive necessary backing from leadership and stakeholders. This alignment creates a clear rationale for pursuing specific projects, especially when resources are limited.

Another key factor is resource availability. Organizations must consider the financial, human, and technological resources required for each potential project. Prioritization becomes simpler when decision-makers assess the balance of available resources against the demands of each initiative. Projects that align closely with strategic goals yet require less investment may rise to the top of the priority list, making efficient use of limited resources while still supporting the company's vision.

Risk assessment also plays a significant role in portfolio prioritization. Each project carries its own inherent risks that can impact its chances of success. By evaluating the risk versus reward of each initiative, organizations can make informed choices about which projects to prioritize.

Risk assessments should include both qualitative and quantitative factors, allowing decision-makers to understand the potential impacts of each project on overall organizational performance.

Aligning Portfolio Choices with Organizational Goals

Aligning portfolio choices with organizational goals requires a strategic framework that establishes a clear connection between project selection and the company's vision. One effective method to achieve this alignment is through the use of a balanced scorecard, which translates strategic objectives into tangible performance metrics.

This tool allows organizations to assess how well potential projects contribute to achieving their goals, providing a basis for prioritization.

Another important aspect of alignment is ensuring that there is a clear understanding of stakeholder priorities. Conducting stakeholder analysis helps organizations identify key players, their expectations, and how their needs can be integrated into the decision-making process.

By actively engaging with stakeholders, organizations can prioritize projects that not only serve their strategic objectives but also meet the needs of those impacted by the initiatives.

Moreover, organizations should remain flexible and adaptive in their alignment strategies. The business landscape is constantly changing, and project priorities may need to shift in response to new market trends, technological advancements, or competitor movements.

By regularly revisiting strategic goals and portfolio choices, organizations can ensure continuous alignment and make necessary adjustments as circumstances evolve.

Effective Methods for Evaluating Project Value

Evaluating project value is critical in the portfolio prioritization process. Organizations can employ various methods to assess the potential contribution of each initiative to their strategic goals. One widely used approach is the cost-benefit analysis, which weighs the anticipated benefits of a project against its associated costs.

This method provides a clear financial perspective, enabling decision-makers to understand which projects may yield the highest return on investment.

In addition to financial assessments, qualitative evaluations are equally important. Projects should also be assessed based on their strategic fit, potential for innovation, and alignment with market demand. Techniques like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) can help organizations understand the broader context in which a project operates and its potential impact on the organization’s competitive positioning.

Scoring models are another effective method for evaluating project value. By assigning numerical scores to various factors such as strategic alignment, risk, and resource requirements, organizations can create a comprehensive view of each project’s potential value. This quantitative approach can help prioritize projects based on a standardized measurement system, making it easier to compare and contrast different initiatives.

Balancing Risk and Reward in Portfolio Management

Balancing risk and reward is a fundamental aspect of effective portfolio management. Organizations must recognize that every project carries inherent risks, and it is vital to assess these risks in relation to the potential rewards.

Risk management frameworks can guide organizations in identifying, analyzing, and mitigating risks associated with different initiatives. This proactive approach enables decision-makers to understand the trade-offs between risk levels and expected outcomes.

One effective strategy for balancing risk and reward is to incorporate a risk-adjusted return on investment (ROI) metric. This approach adjusts traditional ROI calculations by factoring in the risks associated with each project. By using risk-adjusted metrics, organizations can prioritize projects that offer attractive returns while remaining mindful of the associated risks, leading to more informed decision-making.

Furthermore, organizations can create a diversified portfolio to spread risk across different projects. By investing in a mix of high-risk, high-reward initiatives alongside more stable, lower-risk projects, organizations can achieve a balanced portfolio that mitigates potential losses while maximizing growth opportunities.

This diversification not only reduces the overall risk exposure but also aligns with strategic goals by ensuring that a variety of initiatives contribute to the organization's success.

Using Data Analytics for Informed Prioritization

In today's data-driven landscape, organizations can leverage data analytics to enhance their portfolio prioritization processes. By harnessing large volumes of data, organizations can gain insights into market trends, customer preferences, and project performance, enabling informed decision-making. Predictive analytics can also forecast the potential success of various initiatives, helping organizations prioritize projects with the highest likelihood of achieving strategic goals.

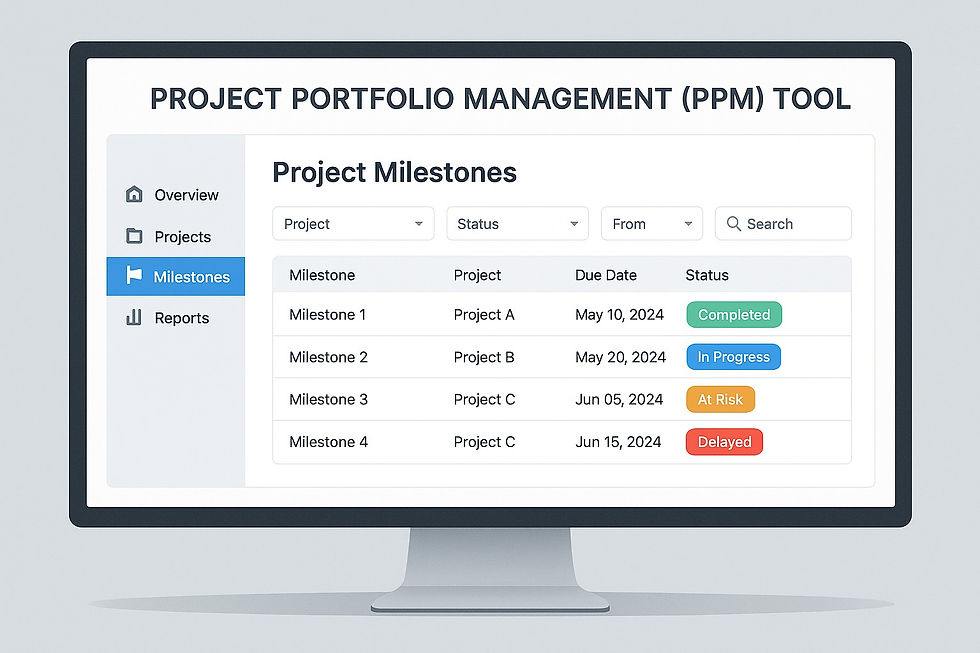

Data visualization tools can further support the prioritization process by creating intuitive dashboards that display project metrics and performance indicators in real time. These visualizations allow decision-makers to quickly assess the status of various initiatives and identify areas that require attention.

By presenting data in an easily digestible format, stakeholders can engage in discussions that lead to more effective prioritization.

Moreover, organizations can enhance their portfolio management practices by implementing advanced analytics techniques such as machine learning.

These algorithms can analyze historical project data to identify patterns and correlations, providing organizations with predictive insights that inform future project decisions. By embracing data analytics, organizations can elevate their portfolio prioritization strategies and align them more closely with their strategic goals.

Engaging Stakeholders in the Prioritization Process

Engaging stakeholders in the portfolio prioritization process is essential for fostering a sense of ownership and ensuring alignment with organizational goals. Stakeholders bring diverse perspectives and insights that can enrich the decision-making process, leading to more thoughtful and comprehensive evaluations of potential projects. By actively involving stakeholders, organizations can better understand their expectations and priorities.

One effective approach to stakeholder engagement is to hold collaborative workshops where teams can collectively discuss and evaluate potential projects. These sessions allow participants to share their viewpoints, raise concerns, and contribute to the decision-making process. By facilitating open dialogue, organizations can create a collaborative atmosphere that encourages creative thinking and innovative solutions.

Moreover, establishing clear communication channels is vital for ongoing stakeholder engagement. Regular updates on project progress, changes in strategic direction, and the outcomes of prioritization decisions foster transparency and trust.

By keeping stakeholders informed, organizations can cultivate a culture of collaboration that enhances buy-in and support for prioritized projects, ultimately leading to greater success in achieving strategic goals.

Best Practices for Continuous Portfolio Optimization

Continuous portfolio optimization is critical for organizations seeking to maintain alignment with strategic goals in an ever-changing business environment. One best practice is to establish regular review cycles for portfolio performance. By conducting periodic assessments, organizations can evaluate whether their selected projects are delivering the desired outcomes and make necessary adjustments in response to changing conditions.

Another best practice is fostering a culture of learning and adaptation. Organizations should encourage teams to share insights and lessons learned from completed projects, both successful and unsuccessful.

This knowledge sharing can inform future prioritization decisions and help organizations refine their approach to portfolio management. By embracing a growth mindset, organizations can remain agile and better positioned to pivot as needed.

Lastly, investing in training and development for project managers and portfolio leaders is essential for continuous optimization. By equipping team members with the latest tools, techniques, and methodologies, organizations can enhance their ability to prioritize effectively and align projects with strategic goals.

This commitment to professional development not only strengthens the organization's capacity for portfolio management but also fosters a culture of excellence and innovation.

In conclusion, effective portfolio prioritization strategies that align with organizational goals are crucial for navigating today's dynamic business landscape. By understanding the key factors influencing prioritization decisions, employing effective evaluation methods, and engaging stakeholders, organizations can create a robust portfolio that maximizes value.

Continuous optimization and a commitment to learning will ensure that businesses remain agile and responsive, effectively positioning themselves to achieve their strategic objectives.

Frequently Asked Questions

What is portfolio prioritization and why is it important?

Portfolio prioritization is the systematic process of evaluating and ranking projects based on their strategic value and impact on organizational goals. It is crucial because it ensures that resources are allocated to initiatives that drive maximum business value, improve ROI, and align with long-term strategic objectives.

How do organizations determine which projects to prioritize?

Organizations assess projects by evaluating strategic alignment, potential benefits, risk levels, resource requirements, and expected returns. Scoring models, weighted criteria, and stakeholder input are often used to create a structured and objective approach to prioritization.

Who should be involved in portfolio prioritization decisions?

Key stakeholders, including executives, project managers, department heads, and finance teams, should participate in the prioritization process. Their combined perspectives ensure that the portfolio reflects strategic priorities, operational realities, and resource constraints.

How often should portfolio prioritization be reviewed?

Portfolio prioritization should be reviewed regularly, typically quarterly or semi-annually, to adapt to changes in market conditions, organizational goals, or resource availability. Continuous reassessment helps organizations remain agile and responsive to new opportunities or risks.

What tools and frameworks support effective portfolio prioritization?

Organizations often use portfolio management software, scoring models, decision matrices, and dashboards to evaluate and visualize project priorities. These tools enhance transparency, provide real-time insights, and facilitate strategic decision-making across teams.

How does portfolio prioritization impact organizational performance?

Effective prioritization ensures that high-value projects receive the necessary focus and resources, reducing wasted effort and accelerating outcomes. It improves alignment between initiatives and corporate strategy, strengthens stakeholder confidence, and drives measurable business results.

Can portfolio prioritization address risk management?

Yes, prioritization frameworks typically incorporate risk assessment, enabling organizations to balance high-reward projects with acceptable risk levels. This approach mitigates potential failures while optimizing the overall portfolio performance.

What are common challenges in portfolio prioritization?

Challenges include conflicting stakeholder priorities, incomplete data, unclear strategic objectives, and resistance to change. Overcoming these requires structured processes, clear communication, and executive sponsorship.

Conclusion - Portfolio Prioritization Strategies That Align with Strategic Goals

Effective portfolio prioritization is no longer a discretionary exercise it is a fundamental capability for organizations operating in complex, resource-constrained environments. As portfolios expand and initiatives compete for funding, talent, and executive attention, the ability to make deliberate, data-driven prioritization decisions becomes a critical differentiator between organizations that execute strategy successfully and those that struggle with overload and misalignment.

When portfolio prioritization is approached as a strategic discipline rather than a one-time ranking exercise, it enables leaders to maintain a clear line of sight between organizational objectives and execution. It ensures that resources are directed toward initiatives that deliver the greatest value, manage risk appropriately, and support long-term business goals. Just as importantly, it creates the flexibility required to adapt when market conditions, regulatory demands, or strategic priorities shift.

In enterprise environments, effective prioritization also strengthens governance and accountability. Transparent decision-making frameworks reduce ambiguity, limit politically driven initiatives, and establish a shared understanding of why certain projects move forward while others do not. This clarity improves stakeholder confidence, supports better change management, and enhances overall delivery performance across the portfolio.

Ultimately, portfolio prioritization is about focus. Organizations that consistently invest in the right initiatives at the right time and at the right scale are better positioned to realize benefits, sustain competitive advantage, and execute strategy with confidence. By embedding prioritization into ongoing portfolio management practices, leaders can ensure that every project contributes meaningfully to the organization’s strategic success.

Hashtags: #PortfolioManagement #StrategicPlanning #DataAnalytics #StakeholderEngagement #ProjectPrioritization

Discover More great insights at

External Source: For Best Practices for Portfolio Prioritization visit Gartner